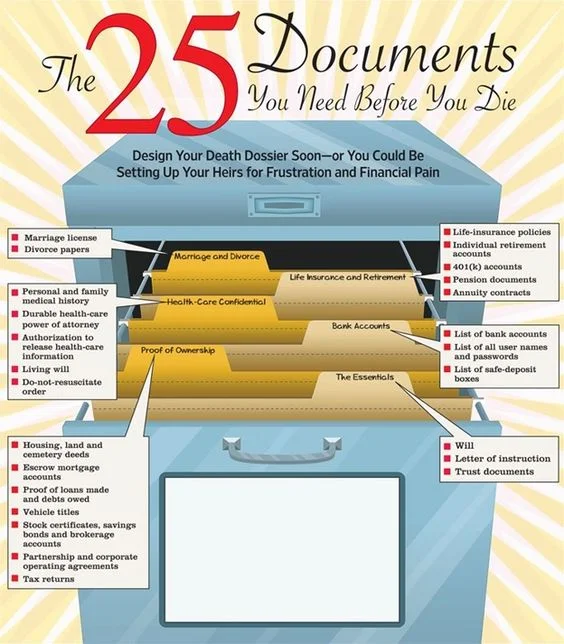

The 25 Documents You Need Before You Die

The financial consequences of failing to keep your documents in order can be significant. According to the recent data, state treasurer's currently hold over $34 billion in unclaimed bank accounts and other assets. Most experts recommend creating a comprehensive folder of documents that family members can access in case of an emergency, so they aren't left scrambling to find and organize a hodgepodge of disparate bank accounts, insurance policies and brokerage accounts. You can store the documents with your attorney, lock them away in a safe-deposit box or keep them at home in a fireproof safe that someone else knows the combination to. That isn't to say you should keep everything. Sometimes people hold onto so many papers that loved ones can't find the important ones easily.

Here is a rundown of the most important documents you'll need to have signed, sealed and delivered. You should start collecting these as soon as possible and update them every few years to reflect changes in assets and preferences. Some - such as copies of tax returns or recent child-support payments - need to be updated more often than others.

- Last Will - An original will is the most important document to keep on file. A will allows you to dictate who inherits your assets and, if your children are underage, their guardians. Dying without a will means losing control of how your assets are distributed. Instead, state law will determine what happens. Wills are subject to probate—legal proceedings that take inventory, make appraisals of property, settle outstanding debt and distribute remaining assets. Not having an original document means this already-onerous process could be much more of an ordeal, since family members can challenge a copy of a will in court.

- Durable power-of-attorney form. Without it, no one can make financial decisions on your behalf in the event that you are incapacitated.

- Proof of Ownership - You should keep documentation of housing and land ownership, cemetery plots, vehicles, stock certificates and savings bonds; any partnership or corporate operating agreements; and a list of brokerage and escrow mortgage accounts. File any documents that list loans and any debts you owe to avoid surprising your family. Make the most recent three years of tax returns available, too.

- Bank accounts - sharing a list of all accounts and online log-in information with your family so they can notify the bank of your death. Be sure to list any safe-deposit boxes you own, register your spouse or child's name with the bank and ask them to sign the registration document so they can have access without securing a court order.

- Health-Care Confidential - durable health-care power-of-attorney form. This allows your designee to make health-care decisions on your behalf if you are incapacitated. The document should be compliant with federal health-information privacy laws, so that doctors, hospitals and insurance companies can speak with your designee. You may also need to fill out an Authorization to Release Protected Healthcare Information form.

- Life Insurance and Retirement Accounts - Copies of life-insurance policies are among the most important documents for your family to have. Family members need to know the name of the carrier, the policy number and the agent associated with the policy.

- Marriage and Divorce - Ensure your spouse knows where you have stored your marriage license. For divorced people, it is important to leave behind the divorce judgment and decree or, if the case was settled without going to court, the stipulation agreement.